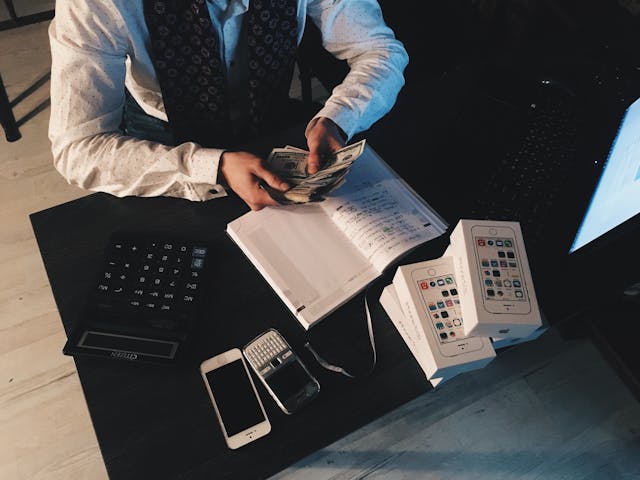

Management of bookkeeping operations within an office environment can be costly due to salaries, training expenses and infrastructure requirements.

Outsourcing can reduce costs while offering multiple advantages, including cost efficiency, time saving and accuracy.

Business owners should also ensure that any firm they hire provides enhanced security systems and that its specialists undergo regular security training that complies with government regulations.

TYPES OF ACCOUNTING

Accounting can be broadly categorized into several types based on the nature and purpose of the accounting information generated. Here are the main types of accounting:

- Auditing

- Financial

- Managerial

- Cost, tax

- Forensic

- Government accounting.

Cost-Effectiveness

Outsourcing bookkeeping services helps companies save money by eliminating expensive overhead expenses associated with hiring employees and purchasing infrastructure, as well as eliminating the hassle associated with managing an in-house accounting department.

Outsourcing is especially helpful for small businesses as it allows them to focus their energy on growing their business without losing precious time on administrative duties.

Outsourced bookkeeping services not only save businesses money but can also help companies allocate their resources more efficiently. For example, small business owners looking to expand their design firm could repurpose the budget that would have gone towards an in-house bookkeeper by using it to fund new equipment or hire additional designers – this reallocation of resources positions businesses for growth by prioritizing investments that promote financial sustainability.

Accuracy is another benefit of outsourcing accounting transactions. Any mistakes in recording accounting transactions could cause major headaches when filing taxes, making decisions based on financial records, or submitting loan applications to banks for loan applications.

An external accounting team can help prevent such mistakes by serving as an extra set of eyes and strengthening internal controls.

Some businesses may be wary of outsourcing bookkeeping services, but their worries can be eased by choosing a partner with sufficient resources to protect data.

By working with an accounting firm that offers secure cloud-based bookkeeping software and employs advanced data encryption technologies, businesses can feel assured that their accounts are being managed in an organized fashion.

Time-Saving

Businesses require reliable and cost-effective bookkeeping service providers to effectively manage their financial processes. A business process outsourcing (BPO) company or public accounting firm should offer services tailored specifically to your budget and needs; choosing the ideal partner is key, as you want them to become part of your team while helping expand your business.

Small business bookkeeping services in USA Excel will evaluate your business’s current financial processes and accounting software before providing a detailed list of available services and pricing structures while communicating directly with you to meet all of your needs.

In essence, hiring the appropriate bookkeeping service allows you to focus on other aspects of running your business while relieving yourself of managing and reconciling financial records – saving both time and energy!

As well as offering quality accounting, bookkeeping service providers can also improve tax preparations and compliance to make filing taxes simpler while saving you money in the long run.

Hiring the appropriate bookkeeping provider can be daunting, yet essential to your business success. Look for one who understands your industry and is transparent with its security practices; additionally, ensure that they have certified accountants available who specialize in your accounting software of choice.

Accuracy

One of the primary advantages of outsourcing bookkeeping is accuracy. Many businesses make costly errors that affect everything from tax filings to strategic planning; these errors can be avoided by teaming up with an accounting firm – they have teams of specialists ready to assist in solving complex issues and staying abreast with current regulations while using various tools to spot-check their work and spot any discrepancies in performance.

Hire these firms on an hourly or flat rate basis – flat rates tend to be more cost-effective as there are no hidden fees involved; an ideal BPO partner will share these rates upfront so you can select which option best meets your business needs.

Outsourcing bookkeeping services is an ideal solution for small and medium-sized businesses, particularly startups that may not yet be ready to hire full-time staff.

Finding a first-rate provider with the ability to manage large volumes of data quickly and efficiently is essential to business growth; tracking key metrics more easily allows more informed decision-making while freeing up your resources to focus on other aspects of the business such as advertising and marketing or product/service development – ultimately increasing customer base growth, leading to more revenue and profits.

Transparency

Businesses must ensure their financial records are accurate and professional when preparing for an audit or seeking investment. Outsourcing bookkeeping services is an ideal way to meet this obligation, delegating responsibility to external professionals or firms offering bookkeeping and accounting services – saving both time and money along the way!

However, choosing a reputable bookkeeping provider requires researching reviews, and testimonials or asking friends or colleagues for suggestions – something outsourcing bookkeeping services allows.

Outsourcing can also increase transparency and decrease fraud. A team of professional auditors will monitor your company’s transactions and accounting work, helping prevent any missteps which could damage its success. Furthermore, outsourcing companies are bound by contracts which ensure strict confidentiality standards are upheld.

Outsourcing may initially seem costly, but its long-term savings outweigh its initial expenses. Furthermore, increased productivity will more than offset any costs incurred from hiring full-time accountants to manage your accounting needs.

Furthermore, Good accounting services in USA will provide detailed reports that give an in-depth picture of your business’s finances while offering suggestions on how to streamline accounting processes and boost efficiency – ultimately increasing competitiveness and driving growth for your organization.